In the chart below, we zoom in on the different ownership groups of American Outdoor Brands. Institutional investors would appreciate the 15% increase in share prices last week, given their one-year returns have been disappointing at 63%. Put another way, the group faces the maximum upside potential (or downside risk). And the group that holds the biggest piece of the pie are institutions with 60% ownership. ( NASDAQ:AOUT), it is important to understand the ownership structure of the business. In fiscal Q2 2022, the company saw 131% growth in the category, topping out at 2,278 customers.īut the company is entering a time of tough comparisons to its performance last year when so many businesses were looking for ways to quickly build out their video chat capabilities.To get a sense of who is truly in control of American Outdoor Brands, Inc.

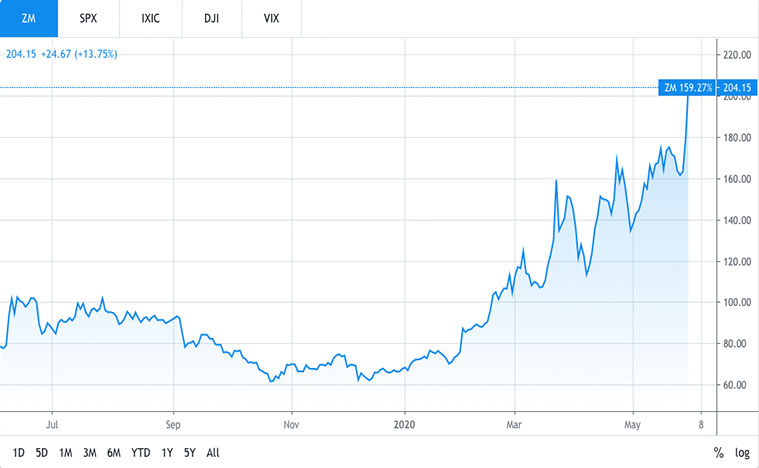

:max_bytes(150000):strip_icc()/zm_one_year_return-cefa5c334f2a4f84b8c4408306fb90f6.png)

The number of such customers shot up 112% from 466 in fiscal Q2 2020 to 988 in fiscal Q2 2021.

That growth, however, slowed in Q2 2022 to 36%, with the company reporting 504,900 such customers.Ĭustomers paying more than $100,000 in the trailing 12 months, though, continues to grow. User growth exploded for Zoom throughout the pandemic, with the number of customers with 10 or more employees skyrocketing 458% from 66,300 in fiscal Q2 2020 to 370,200 during the company’s fiscal Q2 2021. It also provided everyday people around the world with the means to see family and friends, earning it the distinction of Yahoo Finance’s Company of the Year in 2020. The company’s video communication software served as a lifeline for students learning remotely and businesses trying to stay in touch with customers and employees amid a global pandemic. Zoom has been the epitome of coronavirus growth stocks.

This content is not available due to your privacy preferences.

0 kommentar(er)

0 kommentar(er)